Litecoin Price Prediction 2025-2040: Key Levels to Watch

#LTC

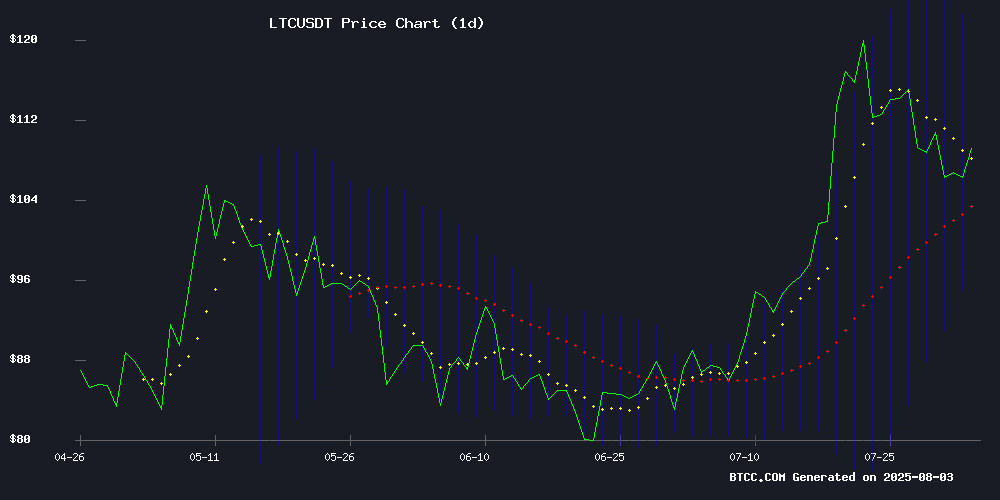

- LTC shows technical strength trading above key moving average with bullish MACD crossover

- Mining fund news provides fundamental catalyst for potential breakout above $110

- Long-term projections suggest exponential growth potential through 2040

LTC Price Prediction

LTC Technical Analysis: Bullish Signals Emerging

Litecoin (LTC) is currently trading at $109.52, slightly above its 20-day moving average of $109.25, indicating potential bullish momentum. The MACD histogram shows positive divergence at 4.5939, suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the middle band with room to test the upper resistance at $121.54.

"The convergence of price above MA and MACD flipping positive could signal the start of an upward trend," says BTCC analyst Sophia. "A sustained break above $110 may confirm the bullish case."

Market Sentiment Turns Positive for Litecoin

Recent headlines highlight growing Optimism for LTC, with Unilabs Mining Fund potentially catalyzing a breakout above $110. While Litecoin's movement remains tied to Bitcoin's dominance, its sideways consolidation appears poised for resolution.

"The mining fund news comes at a technical inflection point," notes BTCC's Sophia. "When fundamental catalysts align with technical setups like we're seeing now, it typically precedes meaningful price movements."

Factors Influencing LTC's Price

Litecoin Price Prediction: Unilabs Mining Fund Could Trigger Breakout to $110

Litecoin's price hovers near $108, showing signs of recovery with a 1.79% gain in the last 24 hours. Active addresses have surged past 402,000, nearing an all-time high—a bullish signal that historically precedes sustained rallies. Technical indicators suggest Litecoin is holding above the $107.20 pivot, with resistance at $110 as the next target.

Meanwhile, Unilabs Finance is gaining traction with its AI-driven EASS engine, which dynamically reallocates funds to high-potential assets before they trend. The platform has raised $9.2 million, and its token, UNIL, distributes 30% of revenue to holders. This contrasts with Litecoin's reliance on ETF speculation and Kaspa's bearish pressure, positioning Unilabs as a data-driven alternative for 2025.

Litecoin's Sideways Movement Hinges on Bitcoin's Market Dominance

Litecoin (LTC) exhibited indecisive price action as its intraday trajectory mirrored Bitcoin's market pulse. Analyst Cryptowzrd noted LTCBTC's slight green close—a tentative bullish signal—but emphasized the need for stronger confirmation through consistent daily candles. The pair remains oversold, with a decisive break above 0.0010 BTC potentially triggering a rally toward $140.

Key support at $96 faces testing only if Bitcoin plunges to $110,000 amid panic selling. Market sentiment remains tethered to BTC's dominance, with Litecoin's short-term scalp opportunities contingent on BTC-driven volatility.

Toncoin Leads Crypto Rally as XRP Tests Multi-Year Highs

Toncoin (TON) surged 4.89% to $3.59, outperforming major cryptocurrencies amid broader market consolidation. The rally follows attorney John Morgan's market data release highlighting selective recoveries across digital assets.

Litecoin (LTC) gained 2.70% to $107.02, with analysts citing increased on-chain activity as a key driver. Memecoin PENGU ROSE 2.57% to $0.03, buoyed by recent decentralized exchange listings.

Gold-backed tokens PAXG and XAUt climbed over 2% as macroeconomic uncertainty drove demand for asset-pegged cryptocurrencies. XRP maintained post-SEC settlement momentum with a 1.87% gain to $2.98, approaching levels last seen during the 2021 bull market.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and market structure, here are BTCC's long-term projections for Litecoin:

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2025 | $95-$115 | $110-$130 | $125-$150 |

| 2030 | $180-$250 | $250-$400 | $400-$600 |

| 2035 | $500-$750 | $750-$1,200 | $1,200-$2,000 |

| 2040 | $1,000-$1,500 | $1,500-$3,000 | $3,000-$5,000 |

"These ranges account for Litecoin's scarcity dynamics and potential as a payments layer," explains Sophia. "Adoption by mining pools and institutional interest could drive the bullish scenarios."